Enterprise social selling in 2023: What do B2B marketers need to know?

One of a kind: ReadyForSocial™ ist das einzige All-in-One Programm, mit dem Ihr Vertriebsteam das volle Potenzial sozialer Medien ausschöpfen kann.

Our social selling expert Monika Ruzicka gives her take on enterprise social selling in 2023. This article first appeared as a LinkedIn article published on her personal profile.

2023 is my 8th year in social selling. For those who don’t know this, here’s some quick context: I work for a boutique social selling company that started in 2013. We’re a hybrid SaaS provider and agency, primarily offering social selling services to large businesses in Europe and the US. We have a few very large clients, all focusing on B2B. Our clients typically hire us for one of two reasons:

- Implement and manage a new social selling program or:

- Complement, optimize, or grow an existing program or initiative. Take it to the next level

When I say “social selling program,” I am referring to what most large businesses and enterprises put together for their (sales) organization and what’s in line with the definition of research and advisory firm Forrester*:

A social selling program commonly involves the following elements: training for the sales team on how to use social media (most often LinkedIn), social media guidelines or policies, enablement in the form of tooling and/or content provisioning, and last but not least program steering by someone in Marketing who oversees the program tracks its results and supports the social sellers.

Social selling programs often start as a small-scale initiative as a pilot or proof of value and grow from there.

Our largest social selling program at my company, ReadyForSocial, has over 1,000 social sellers. Most of our clients stay with us for years. The first program where I led the implementation for our client kicked off in early 2018. It is still running and growing strong.

Where is social selling in 2023?

Social selling is still relatively new. People and companies continue to learn and figure it out, even after the pandemic, with its acceleration in digital relationship-building and buyer behavior. Still, there are many individuals, and probably individual companies, for whom social selling is already ‘business-as-usual.’

Still in the early adoption stage?

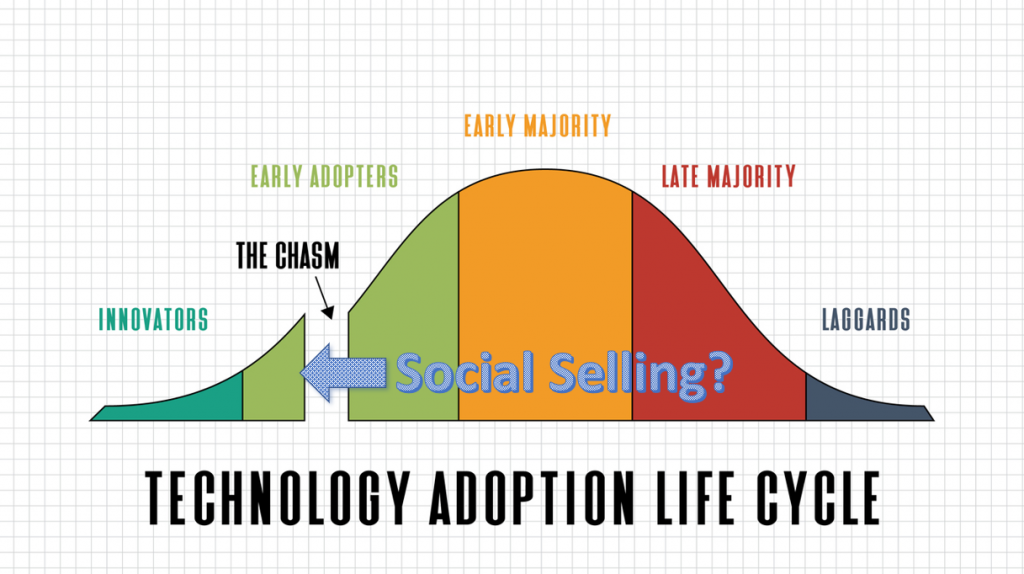

Markus Härlin, Head of Inhouse Sales Consulting at recruiting company Hays, recently described social selling as still being in the “early adoption” stage, alluding to the technology adoption lifecycle. In a conversation with Tomas Herzberger on his podcast “LinkedIn Lounge”**, they talked about social selling being close to the “chasm” point, the transition from the early market into the mainstream, or around 18% of adoption.

Technology Adoption Lifecycle Image: moxumbic via iStock.com

That was an interesting way to put it, as it connected some dots with data I had compiled earlier. My data leads me to agree with Markus’ assessment, and I hope it adds some flavor to it (check it out below).

The data on social selling adoption

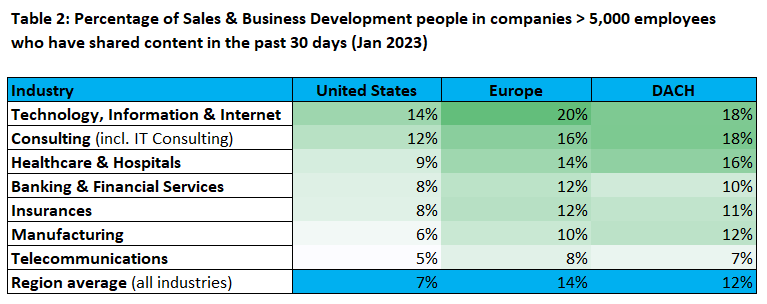

In our business, we evaluate the degree of social selling adoption as the percentage of salespeople in a company or industry who actively share content on LinkedIn. We call it a “Social Selling Power Audit.” It’s a quick snapshot based on LinkedIn Sales Navigator data**. It’s not perfect, but over the years, it has proven to be a reliable indicator, as content sharing is an essential part of social selling for many, including the typical enterprise social selling program.

Do you want to know where your social selling program stands on the spectrum of maturity? How do you compare to others in your industry? Message me, and we can talk.

Where is social selling by region?

Our Power Audit data indicates that social selling adoption is the highest in D-A-CH (short for Germany-Austria-Switzerland), with 16% of salespeople & business developers regularly sharing content. This trend goes across all company sizes. All other regions – Europe, North America, etc. – are far below that level.

When looking at the enterprise segment specifically (companies with > 5,000 employees), the highest adoption is in Europe, at 14%.

Illustration (c) Monika Ruzicka, ReadyForSocial; Source: LinkedIn Sales Navigator data, December 2022

Social selling adoption by industry

Similarly, looking at the adoption rate of social selling across different industries, specific sectors, such as Technology, Information & Internet, and Consulting, are leading, reaching around 18% and as high as 20% in D-A-CH and Europe, respectively. I think it is fair to say that these industries in those geographies are the only ones where social selling has reached the early mainstream.

Illustration (c) Monika Ruzicka, ReadyForSocial; Source: LinkedIn Sales Navigator data, January 2023.

Enterprise social selling in 2023: Observations

The most striking observation for me is the regional difference between the US and Europe, especially in sales and business development roles (3.7% vs. 10.0%). I would love to discuss if you work in both markets or have any ideas that might explain this difference. I think it might have something to do with LinkedIn having an overall larger sales “population” in the US (27 M vs. 20 M in Europe) or a different breakdown between B2C and B2B – with social selling and content on LinkedIn being primarily a B2B topic.

In terms of industries, I was surprised by the higher-than-expected activity in traditional sectors, such as manufacturing, and regulated industries, like banking, financial services, and insurance. Early conversations with companies in banking and manufacturing led me to believe that the difference in adoption would be more significant. Most of the clients that I work with are in technology & IT. Do you work in any of these industries? What do you think about this data?

What does this mean for B2B marketers?

Social selling can help you be successful.

The industries that implemented social selling first, around 2010 – 2012, notably the tech sector with companies like IBM, Microsoft, undSAP, are reaching market maturity. It has taken ten years from the pioneer days.

To date, most of our clients at ReadyForSocial are also from the tech and IT sectors. They all see the results of social selling and are looking to further develop and expand their programs in 2023.

Across all our clients:

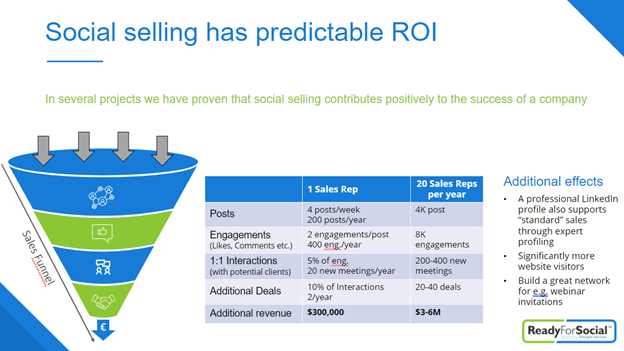

- Social selling helped generate around 1M social engagements, thousands of deals, and tens of millions of dollars in deal value in 2022.

- We see an ROI of 5-8X for enterprise social selling programs.

If you are looking to predict the ROI for your organization, you can refer to the illustration below, which we have put together with actual data from our almost decade of social selling:

(c) ReadyForSocial, 2023

Do you lead or fall behind?

In 2023 (and maybe 2024), B2B companies who have already implemented social selling initiatives or programs will be among the early adopters and will have an advantage in building relationships and influence on LinkedIn in their audience of customers, prospects, and – not to forget – talent, future employees.

For businesses that have been waiting to tackle LinkedIn until now, it’s an excellent time to get started and learn from the early adopters. You can gain real, incremental revenue if you do social selling right.

Most marketers are on their first social selling program – learning is part of the journey.

As marketers, chances are you haven’t implemented many social selling programs or initiatives yet. The one you’re currently managing – or looking to start – is likely your first.

Introducing and growing social selling in your organization is a journey with many learnings and no well-trodden path to follow.

Many aspects, like where to start, how to get senior leadership buy-in, what sellers to include in your initial test pilot or proof-of-concept, how to train your sales force, how to evaluate success, build your social content strategy, etc., will have to be somewhat tailored to your company. But there are ‘blueprints’ and resources available that you can use. I want to share two here that I have helped put together:

- How to get started with social selling to increase your ROI

- What does it take to have a social selling program that drives results

If you prefer to listen, here are some recommendations for great episodes from my podcast “Straight to Business – Social Selling for B2B,” where enterprise marketing leaders talk about their own experiences with implementing social selling:

- “Why social selling in B2B” with Björn Radde, VP, Digital Experience, at T-Systems International. You can listen to this episode on Spotify or Apple Podcasts / iTunes.

- “How to enable your organization for social selling success” with Andreas F. Klauser, Head of EMEA Field Marketing at Zoom: Spotify or iTunes.

- “How marketing can support their organization with social selling,” with Wiebke Kraus, Senior Digital Marketing Manager at SPS: Spotify or iTunes.

If you are part of my German-speaking network, here’s another great one from the “LinkedIn Lounge” podcast by Tomas Herzberger:

- “Social Selling mit Julia Pichler”, with Julia Pichler, B2B Field Marketing and Social Selling at Canon EMEA: Spotify or Apple Podcasts/iTunes.

What does social selling cost?

If you are wondering what enterprise social selling costs are, here’s a reference point for you: For a complete program (training, content, platform/analytics, program management), you’re looking at the cost of $100 to $200 per social seller per month (this does not include a potential LinkedIn Sales Navigator license). The price is approximately the same, independent of your sourcing strategy (whether you handle all program elements in-house, partly, or fully outsourced). It’s more a matter of whether it’s your internal cost or payout to a 3rd party vendor or agency.

What’s next?

I hope some of these thoughts and data points were helpful to you. I love discussing social selling. Whether you are looking into a new social selling program, further building, or expanding your existing one, have comments on my data, or have a different point of view, feel free to leave me a comment or personal message. Happy social selling in 2023, and thank you for reading! 🙏🏽

#Marketing #B2B #socialselling

Photos by: Kaboompics on pexels; Chase Clark on Unsplash; imaginima on iStock.com; andresr on iStock.com; Image: iStock.com; and marrio31 on iStock.com.

Footnotes:

* Forrester, a leading research and advisory firm in the area of business and technology, defines ‘formal’ social selling programs in the following way: “you have trained your reps on social selling best practices, you have governance and policies, and you have systems and tools in place to support your sellers.” Source: Forrester Report: Add Social Selling To Your B2B Marketing Repertoire It’s Time For B2B Sellers To Fully Embrace The Channel, 2017.

** Conversation with Tomas Herzberger on his podcast “LinkedIn Lounge” episode 66 “Social Selling für Key Accounts mit Markus Härlin” (in German language)

*** We use the Sales Navigator to estimate the number of sales & business development people in a specific company or industry. Next, we filter by those profiles that have shared content in the past 30 days. It’s not “perfect” because 1) content sharing is only one element of social selling. Many salespeople use LinkedIn to network and communicate with clients and prospects without necessarily sharing content. And 2) Content sharing on LinkedIn, evaluated with the Sales Navigator, does not prove the quality of the content, or differentiate between posting and re-sharing. Still, I see it as a pretty good indicator.